The EU's Regulatory Fines: Intent, Necessity, and Impact Across Key Sectors

August 04, 2025 - SelfcomplaiAbstract

This analysis explores the European Union’s financial framework, emphasizing the strategic role of regulatory fines within its broader budgetary system. While the EU’s income predominantly derives from member state contributions based on GNI and VAT, regulatory penalties particularly under GDPR serve primarily as enforcement tools rather than significant revenue sources. Collected fines largely benefit national treasuries and constitute a minor fraction of the EU’s overall budget. The fines function as deterrents, incentivizing corporate compliance and safeguarding market integrity. For businesses, non-compliance entails far greater costs beyond fines, including operational disruption, legal liabilities, and reputational damage, underscoring the economic rationale for proactive compliance investment. Ultimately, EU fines reinforce trust in its regulatory environment, supporting long-term economic stability and societal well-being.

Introduction: The Purpose of EU Fines

Unpacking the Strategic Intent and Necessity of These Penalties

The European Union's financial framework is a sophisticated system designed to support common policies and programs across its member states. Within this framework, regulatory penalties levied against corporations, particularly those in the technology sector, frequently capture public attention due to their substantial individual amounts. They are, in essence, fundamental tools designed to ensure compliance with EU laws, deter future violations, and promote responsible corporate behavior across the Union (European Commission, n.d.). The imposition of fines is not an arbitrary act but a calculated measure within a broader regulatory strategy. This strategic articulation of the EU's regulatory philosophy emphasizes a proactive, forward-looking approach, aiming to shape market conduct and corporate culture rather than merely punishing past transgressions (European Commission, n.d.).

Deterrence, Compliance, Market Integrity, Consumer Protection

The EU's regulatory fines serve a diverse array of objectives that collectively reinforce the Union's values and ensure the effective functioning of its single market. These objectives include fostering fair competition by preventing anti-competitive practices, safeguarding the fundamental right to privacy and protecting consumer data in an increasingly digital world, ensuring the stability and transparency of financial markets, and promoting environmental responsibility. The fines act as a powerful economic disincentive, compelling companies to adhere to legal standards and preventing behaviors that could lead to market failures or create negative externalities, such as data breaches or environmental damage. This comprehensive approach underscores that the EU views fines as a critical instrument for maintaining market integrity and protecting its citizens, with any revenue generated being a secondary byproduct of this primary regulatory mandate (European Commission, n.d.).

Why the EU Imposes Fines

A. Deterrence and Compliance: Shaping Market Behavior

Fines as a Powerful Economic Incentive for Adherence to EU Laws

It is essential to understand the strategic intent behind the imposition of regulatory penalties. These fines serve a purpose far more profound than simply generating income; they are fundamental tools for ensuring compliance, deterring future misconduct, and shaping market behavior (European Commission, n.d.). The primary objective of regulatory penalties, particularly in domains such as data protection, antitrust, and environmental compliance, is not to generate revenue but to enforce adherence to laws and deter future violations. Fines act as a powerful economic incentive, compelling companies to implement and maintain robust measures for data protection, cybersecurity, environmental standards, and fair market practices.

Principles Guiding Fine Determination: "Effective, Proportionate, and Dissuasive"

The design of EU fines is guided by core principles to ensure their impact. For example, GDPR fines are explicitly designed to be "effective, proportionate, and dissuasive" (Intersoft Consulting, n.d.). This means that the penalties are tailored to the severity of the infringement, aiming to be significant enough to deter future misconduct without being unduly punitive. This careful calibration ensures that the fines achieve specific behavioral outcomes, aligning with the EU's broader regulatory goals (Tokic, 2025).

Factors Considered in Fine Calculation (Gravity, Duration, Intent, Mitigation, Cooperation)

The determination of regulatory fines involves considering various factors, demonstrating a structured, rather than arbitrary, approach. For GDPR fines, these factors include the nature, gravity, and duration of the infringement, whether it was intentional or negligent, actions taken by the company to mitigate damage, the degree of responsibility, and any relevant previous infringements (European Commission, n.d.). For competition law, gravity and duration are also key determinants, with specific guidelines for calculating the "Basic Amount" based on a percentage of sales in the affected market multiplied by the duration of the infringement, plus an "entry fee" to deter cartels (European Commission, n.d.).

The EU's approach also incorporates incentives for cooperation. Companies that proactively self-report violations, demonstrate solid precautions, or cooperate with investigations may face lower fines (European Commission, n.d.). For instance, in cartel cases, the European Commission encourages companies to come forward with evidence, offering full immunity from fines for the first company to provide sufficient evidence, and reductions of up to 50% for subsequent companies depending on their timing and added value (European Commission, n.d.). A 10% reduction is also granted for settlement (European Commission, n.d.). This strategic element of the EU's fining policy incentivizes proactive compliance and cooperation, rather than just being a reactive punishment. The lower fine acts as a reward for good behavior, encouraging companies to self-police and collaborate, which ultimately makes the regulatory system more efficient and effective. This suggests the EU is not just a "punisher" but also a "partner" in achieving compliance.

Evidence of Fines Driving Behavioral Change and Fostering a Culture of Compliance

Research indicates that decisions by Data Protection Authorities (DPAs) that include a fine significantly influence decision-makers to prioritize compliance (NOYB, 2025). Even more compelling, respondents stated that DPA fines imposed against other organizations would influence their own company's GDPR compliance efforts (NOYB, 2025). This demonstrates the dual nature of deterrence: specific deterrence (punishing the undertaking concerned) and general deterrence (deterring other undertakings) (Veljanovski, 2022). The public visibility of fines, even if the revenue goes to national treasuries, serves this broader deterrent purpose, sending a clear signal to the entire market. This highlights the EU's aim to shape industry-wide behavior and foster a culture of compliance through indirect means.

Concrete examples further illustrate this behavioral change. Apple, for instance, made significant updates to its App Store to comply with the Digital Markets Act (DMA) and avoid daily fines, splitting its store services options and altering its fee structure (Clover, 2025). This direct modification of business practices in response to regulatory pressure underscores that the threat of penalty and the enforcement action itself are powerful incentives, shifting the focus from the revenue collected to the broader impact on market behavior and regulatory adherence. Regulators frequently impose penalties to address market failures or behaviors that create negative externalities, such as data breaches, anti-competitive practices, or environmental damage. The fines internalize these external costs, forcing companies to bear the true cost of their actions, thereby promoting a more efficient and socially responsible market outcome. This moves beyond simple "punishment" to "market optimization."

B. The Broader Costs of Non-Compliance for Businesses

While regulatory fines are a direct and visible consequence of non-compliance, they often represent only a fraction of the total cost incurred by businesses. The true financial and reputational repercussions of failing to adhere to regulations are far more severe and multifaceted, making proactive investment in compliance a strategic imperative rather than a mere cost center.

Direct Costs Beyond Fines: Data Breaches, Legal Fees, Operational Disruption, Remediation

Data breaches are a pervasive and costly consequence of non-compliance, especially in the context of cybersecurity regulations. The global average cost of a data breach escalated to $4.88 million in 2024, marking a 10% increase from the previous year (IBM, 2024). Notably, breaches become substantially more expensive when non-compliance with regulations is identified as a contributing factor, costing nearly $220,000 more on average. For organizations with a high level of non-compliance, the average data breach cost can further escalate to $5.05 million (Sharavanan, 2024). These costs encompass a wide range of expenses, including detection, containment, notification of affected parties, post-breach response activities, and necessary system upgrades (Chinnasamy, 2025).

Non-compliance can also trigger extensive legal repercussions, ranging from civil lawsuits and government investigations to, in severe cases, criminal charges. The associated legal expenses for specialized counsel, court costs, and settlements can be astronomical. For example, the 2013 Target data breach, caused by a failure to secure vendor access, cost the company nearly $292 million in legal fees, settlements, and compensation (Chinnasamy, 2025). Similarly, Premera Blue Cross faced a $6.85 million fine in 2020, but this was coupled with significant additional remediation costs after failing to encrypt and monitor patient data, leading to the exposure of nearly 10 million patient records (Chinnasamy, 2025). Regulatory investigations, remediation efforts, and security incidents can severely disrupt normal business operations, leading to significant downtime and substantial loss of productivity. Following an incident of non-compliance, organizations also face considerable expenses for forensic investigations, external audits, and implementing corrective actions to regain compliance and address underlying vulnerabilities (Ciancimino, 2023).

Indirect and Long-Term Costs: Reputational Damage, Loss of Customer Trust, Increased Insurance Premiums, Market Exclusion

Beyond direct monetary outlays, non-compliance can severely tarnish an organization's brand image, leading to a profound erosion of customer trust. This often results in customer churn, difficulties in attracting new business, and a decline in overall sales and market value. For large breaches, the impact on reputational intangible capital can be a significant 5–9% decline (RSM Global, 2025). Organizations with a history of non-compliance or security incidents may also face higher cybersecurity insurance premiums and potentially new coverage exclusions, thereby increasing their ongoing operational costs (Trinh, 2025). Furthermore, failure to comply with specific government regulations, particularly for contractors, can result in the loss of lucrative contracts or funding opportunities, directly impacting future revenue streams. Non-compliance incidents can also negatively impact employee morale, leading to higher turnover rates and challenges in attracting and retaining top talent, which in turn incurs additional recruitment and training costs. For regulations like the EU Deforestation Regulation (EUDR), non-compliance can even result in restricted access to the EU market, a critical revenue source for many companies, forcing them to find alternative markets, often at lower prices (LiveEO, 2025). This risk extends beyond direct producers to downstream players sourcing from non-compliant companies, highlighting that due diligence is not just a formality but essential for all companies placing affected products on the EU market (LiveEO, 2025).

The Economic Reality: Non-Compliance Costs Significantly Outweigh Compliance Investments

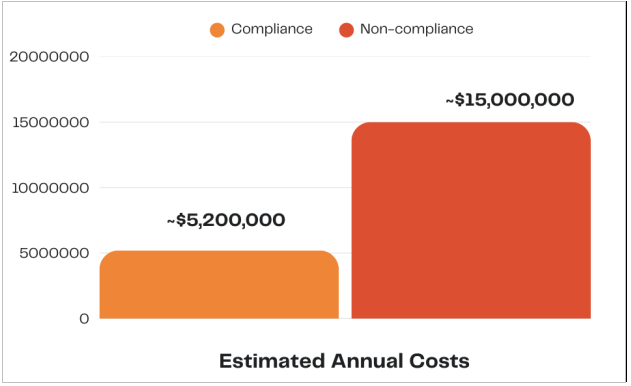

The average cost of non-compliance can be 2.65 to 3 times greater than compliance costs. For example, while the average cost of compliance is typically around $3.5 million to $5.5 million, the average cost of non-compliance ranges from $9.4 million to $15 million, and can even reach up to $40 million per incident for severe cases.

The economic rationale behind strict regulatory penalties becomes profoundly clear when considering the total cost of non-compliance for businesses. Fines, while financially impactful, are often explicitly identified as the least expensive consequence of non-compliance (Chinnasamy, 2025). The relatively "low" cost of the fine (compared to the much larger total non-compliance cost) serves as a direct, undeniable financial reminder to companies about the much larger, often hidden, and devastating risks they are running if they fail to maintain compliance.

The fines effectively act as a "wake-up call" or an "initial payment" on potentially far greater, indirect financial losses, thereby strongly incentivizing proactive investment in compliance programs rather than reactive damage control. This strategic approach aims to foster a culture of risk management and market stability, rather than merely enriching the EU's budget.

The following table summarizes the significant financial disparity between investing in compliance and incurring the costs of non-compliance:

| Aspect | Average Cost of Compliance (USD) | Average Cost of Non-Compliance (USD) | Key Components of Non-Compliance Costs (Examples) |

|---|---|---|---|

| Overall | $3.5M - $5.5M | $9.4M - $15M (up to $40M for severe cases) | Business disruption, productivity loss, revenue loss, legal fees, data breach costs, reputational damage, audit & remediation expenses |

| Fines/Penalties | (Included in Compliance Cost) | ~$1.95M (average for fines, penalties & other settlement costs) | Regulatory fines (e.g., GDPR up to €20M or 4% global turnover) |

| Data Breach | (Mitigated by Compliance) | ~$4.88M (global average, 2024) | Detection, containment, notification, lost business, legal fees, regulatory fines |

| Legal Liabilities | (Reduced by Compliance) | Substantial, often surpassing initial fines (e.g., Target $292M) | Lawsuits, government investigations, criminal charges, settlements |

| Business Disruption | (Minimized by Proactive Planning) | ~$5.1M (average) | Operational halts, unplanned downtime, resource diversion |

| Reputation Damage | (Enhanced by Trust) | Immeasurable, but leads to customer churn & revenue loss | Loss of customer trust, negative press, difficulty attracting new business |

This table vividly illustrates that the financial impact of non-compliance on businesses is far broader and deeper than just the regulatory fines. It provides concrete evidence that the economic incentive for companies to comply is overwhelming, as the alternative carries a much greater and more varied financial burden.

Conclusion: Reinforcing the Regulatory Mandate

The analysis of the European Union's financial structure and the nature of its regulatory penalties provides a clear understanding of the EU's sources of income and the strategic role of fines. The European Union's financial backbone is primarily composed of substantial, established contributions from its member states, including significant allocations based on their Gross National Income (GNI) and Value Added Tax (VAT), complemented by traditional own resources such as customs duties (European Union, 2024). This multi-billion euro budget, which consistently runs into hundreds of billions annually (e.g., €142.63 billion in 2024), is specifically designed to fund collective policies and programs across the Union, reflecting shared objectives and responsibilities (European Union, n.d.).

Regulatory penalties, such as those imposed under the General Data Protection Regulation (GDPR), serve predominantly as a critical deterrent and an essential enforcement mechanism to ensure adherence to EU laws and standards (European Commission, n.d.). While individual fines can indeed be substantial for the companies involved, they are largely collected by national data protection authorities and accrue to the treasuries of the respective member states, not directly to the central EU budget (European Commission, n.d.). This decentralized allocation means that the revenue from these fines primarily benefits national governments, not the overarching EU financial framework. When viewed against the immense scale of the EU's total annual budget, the aggregate sum of regulatory fines, even if hypothetically attributed to the central budget, represents a statistically negligible percentage (approximately 3.15% of the 2022 budget, if all cumulative GDPR fines since 2018 were considered in one year and flowed to the EU central budget, which they do not). Therefore, regulatory fines are far from being a primary or even significant source of income for the EU itself. Their strategic purpose is to enforce compliance and deter future violations, with the collected revenue typically benefiting the national treasuries of the member states.

For businesses, the financial implications of non-compliance extend far beyond the direct regulatory fines. The most significant and often hidden financial repercussions stem from extensive business disruption, substantial productivity losses, escalating legal liabilities, and severe, long-lasting reputational damage. These indirect costs frequently far outweigh the direct penalties, underscoring that proactive and robust investment in compliance is a strategic necessity for businesses to mitigate far greater risks, safeguard their operations, and ensure long-term viability and market trust. The fines, in this context, serve as a clear financial signal, prompting companies to address their compliance posture before encountering more devastating, multifaceted economic consequences. The fines, while financially impactful, are often identified as the least expensive consequence of non-compliance, effectively acting as a "wake-up call" or an "initial payment" on potentially far greater, indirect financial losses.

Fines, in this context, serve as a mechanism to enforce the behaviors that foster this trust. When companies are penalized for breaches, it signals to citizens and businesses that the regulatory framework is effective and that their rights and interests are protected. The ultimate necessity of fines is to maintain and enhance trust in the EU's markets and digital environment, which is crucial for long-term economic stability and societal well-being. Without effective enforcement, the regulatory framework would lose its credibility, and trust would erode.

In direct response to the query, regulatory penalties are not the only source of income for the EU. The EU relies overwhelmingly on well-established contributions from its member states. Furthermore, these fines constitute an extremely minor percentage of its overall budget, primarily serving as a vital tool for regulatory enforcement and deterrence, with the collected revenue typically benefiting the national treasuries of the member states (European Commission, n.d.). The EU's regulatory approach is dynamic, adapting to evolving market challenges such as digital transformation and financial crises, demonstrating its commitment to upholding its values, ensuring market integrity, and protecting its citizens and businesses.

References

- Chinnasamy, V. (2025). Compliance vs. Non-Compliance: What It Really Costs Your Business. From Indusface: https://www.indusface.com/blog/cost-of-compliance-vs-non-compliance

- Ciancimino, J. (2023). Regulatory Compliance Costs & Profitability. From IS Partners: https://www.ispartnersllc.com/blog/rising-compliance-costs

- Clover, J. (2025). Apple's Latest App Store Changes Satisfy EU, No More Fines Coming. From MacRumors: https://www.macrumors.com/2025/07/22/app-store-eu-changes-accepted

- European Commission. (n.d.). Fines. From European Commission: https://competition-policy.ec.europa.eu/index/fines_en

- European Union. (2024). Definitive Adoption (EU, Euratom) 2024/207 of the European Union’s annual budget for the financial year 2024. Official Journal of the European Union, Volume L, pp. 1-2087.

- European Union. (n.d.). How the EU budget is spent. From European Union: https://european-union.europa.eu/institutions-law-budget/budget/how-eu-budget-spent_en

- IBM. (2024). Cost of a Data Breach Report 2024. s.l.: s.n.

- Intersoft Consulting. (n.d.). GDPR Fines / Penalties. From GDPR Info: https://gdpr-info.eu/issues/fines-penalties

- LiveEO. (2025). Understanding EUDR Penalties: 10 Business Implications of Non-Compliance. From LiveEO: https://www.live-eo.com/article/eudr-non-compliance-penalties

- NOYB. (2025). Data Protection Day: Only 1.3% of cases before EU DPAs result in a fine. From NOYB: https://noyb.eu/en/data-protection-day-only-13-cases-eu-dpas-result-fine

- RSM Global. (2025). How much will a data breach cost you?. From RSM Global: https://www.rsm.global/insights/how-much-will-data-breach-cost-you

- Sharavanan. (2024). Key Compliance Statistics & Insights For 2025. From Zluri: https://www.zluri.com/blog/key-compliance-statistics-and-insights-for-2024

- Tokic, A. (2025). Optimal fines in EU competition law—an economic analysis. Journal of European Competition Law & Practice.

- Trinh, T. (2025). The Hidden Price Tag: Understanding the Full Cost of Regulatory Non-Compliance. From VisiumKMS: https://www.visiumkms.com/blog/the-hidden-price-tag-understanding-the-full-cost-of-regulatory-non-compliance

- Veljanovski, C. (2022). The Effectiveness of European Antitrust Fines. In: T. Toth, ed. The Cambridge Handbook of Competition Law Sanctions. Cambridge: Cambridge University Press.